In December 2017, Congress passed the landmark Tax Cuts and Jobs Act (TCJA), the most comprehensive tax reform legislation since 1986. The TCJA significantly reduced and simplified the federal income tax burden for American families and workers and modernized the taxation of business income. However, many of the TCJA’s key reforms are set to expire at the end of 2025.

Resolving the 2025 tax cliff will likely be the biggest issue confronting the White House and Congress next year.

A new national survey released by the U.S. Chamber of Commerce reveals where voters stand on one of the biggest issues that will confront the White House and Congress in 2025.

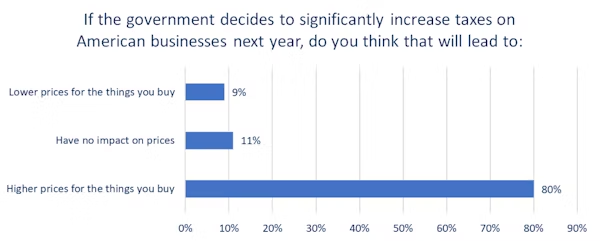

American voters overwhelmingly believe higher taxes on American businesses will lead to higher prices.

Over 80% of those polled believe that higher taxes will lead to higher prices, while only 9% believe higher taxes will lead to lower prices, and 11% believe it will have no impact.

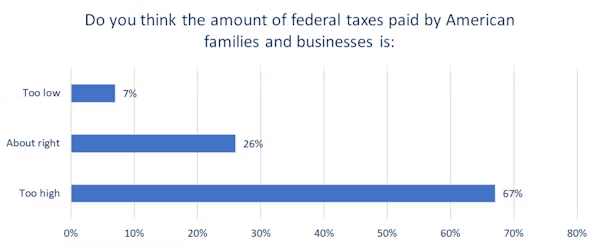

The majority of American voters think the amount of federal taxes paid by American families and businesses is already too high.

Sixty-seven (67%) of American voters think taxes paid by both families and businesses are too high, while a quarter (26%) say taxes paid are about right. Only 7% of voters think taxes are too low.

The national poll surveyed 701 American voters between June 21-25, 2024. The margin of error is ~3.8%.

Source: occamTM by AlphaROC, Inc., All Rights Reserved.

About the Author: Neil Bradley is executive vice president, chief policy officer, and head of strategic advocacy at the U.S. Chamber of Commerce. He has spent two decades working directly with congressional committee chairpersons and other high-ranking policymakers to achieve solutions.