Chamber Members Split: Renew or Repeal?

Voters across Fremont County first approved a ½-Cent Economic Development Tax in November 2020. In the nearly four years since, a negative perception has grown among approximately half of them (according to a recent Forward Fremont PAC poll) regarding how the county and six municipal governments have distributed the proceeds to businesses. In a survey conducted earlier this year by the Lander Chamber, 51% of our members supported renewal of the tax, 34% were opposed, while 15% said they weren’t sure.

Local Governments Respond to Concerns, Make Several Changes to Distribution Agreement

The Fremont County Association of Governments (FCAG), to alleviate the aforementioned concerns, voted 5-2 in early August (the County and Dubois opposing) to adopt several changes to its Memorandum of Understanding (MOU) that governs what percentage, for what purpose, and to which entities the proceeds of the would be distributed.

More to Air and Bus Transportation, Less to Businesses, Ambulance Service Would Be Included

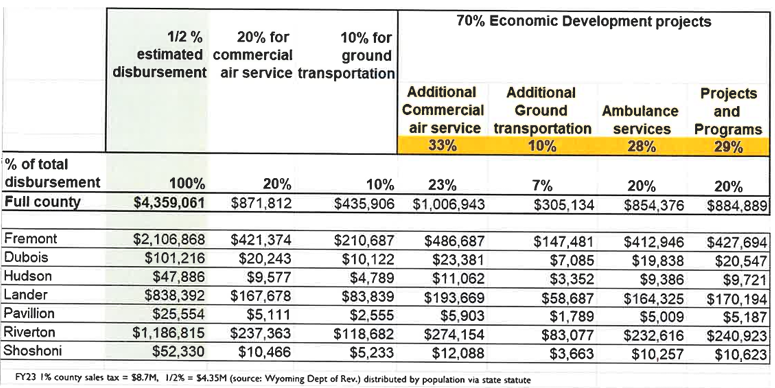

The amended MOU significantly reduces the percentage of the tax that would go to businesses while increasing the percentage allocated to air and bus transportation; it also would add a new allocation for ambulance service. This new distribution breaks down as follows:

- Commercial Air Service at Central Wyoming Regional Airport…………………………43% (was 20%)

- Ground Transportation via Wind River Transportation Authority……………………17% (was 10%)

- Ambulance Service………………………………………………………………………………………….20% (was 0%)

- Economic Development Funding to Local Businesses……………………………………..20% (was 70%)

Award Criteria would be Tightened, Standardized across County and Municipal Governments

Changes also were made to the criteria by which applicants for economic development funding would be judged, including: clear criteria must be established for evaluating such projects; a thoroughly evaluated and transparent review process must be adopted prior to approval; funds must be allocated exclusively within the community and only for the designated purpose of the tax; and collaboration with the County and other municipalities for joint programs that benefit greater Fremont County.

“Claw Back” Provisions Favored by Most Chamber Members not Included, but also not Prohibited

Not included among the changes were “claw back” provisions that would require tax funds to be paid back by awardees if criteria for spending were not met. A large percentage of Chamber members (66%) prefers BOTH tightened up award criteria AND claw back provisions. It is important to note, however, that this would not necessarily prevent the governments from including such provisions in their finalized distribution agreement.

Wherever you stand on this issue, remember to vote on November 5th!

—